by CB McGowan Jr · 2010 · Cited by 26 — We test for the Eid al-Fitr Calendar Effect for the Syariah Index of the Kuala Lumpur Stock. Exchange for the period from 2000 to 2003 and find no statistically

10 pages

164 KB – 10 Pages

PAGE – 1 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 11 Is There A n Eid al – Fitr Effect I n Malaysia? Carl B. McGowan, Jr., Norfolk State University , USA Noor Azzudin Jakob, Universiti Kebangsaan Malaysia , Malaysia ABSTRACT We test for the Eid al – Fitr Calendar Effect for the Syariah Index of the Kuala Lumpur S tock Exchange for the period from 2000 to 2003 and find no statistically significant effect. We examine the adjusted daily excess return and the cumulative adjusted daily excess return for the Syariah Index relative to the Kuala Lumpur Composite Index fo r the five Eid al – Fitr occurrences during the test period for the ninety day period about the Eid al – Fitr celebrations. The empirical evidence does not support the existence of this calendar effect in the Malaysian stock market. Key words: Calendar Effec ts; Muslim calendar; stock returns; anomaly; Market Efficiency; Malaysia. INTRODUCTION tudies of calendar anomalies are extensive and abundant. Ranging from day – of – the – week to month – of – the – year to turn – of – the – month and to turn – of – the – year effect, fin ance researchers report empirical evidence that deviates from the Efficient Market Hypothesis (EMH). Patterns of abnormally high/low returns are detected that violate the assumptions of the EMH. For example, Wachtel (1942) finds that stock returns are ab normally high on Fridays and abnormally low on Mondays. Rozeff and Kinney (1976) find that returns are higher in January than any other month. Ariel (1987) reports the presence of a turn – of – the – month effect where stock returns are found to be higher on t urn – of – the – month trading days. Lakonishok and Smidt (1988) find that returns are significantly higher around the turn of the year. Studies of calendar anomalies have been pursued not only of stock markets (see , for instance, Cross (1973), Linn and Lockwo od (1988), and Ogden (1990)), but have also been extended to other markets , such as the foreign exchange market (Corhay et al, 1995), the futures market (Gay and Kim, 1987), and bond markets (Jordan and Jordan, 1991). Studies are not only conducted for mar kets in the United States , but go beyond the Pacific and Atlantic oceans (see Gultekin and Gultekin ( 1983 ) , Jaffe and Westerfield ( 1989 ) , Agrawal and Tandon ( 1994 ), and Dubois and Louvet ( 1996) ) . In general, most of the documented empirical findings are c onsistent with the presence of a calendar effect. Th e s e findings spur further investigations into the issue by extending the scope of study beyond western calendar effects. Given the diversity and variety of calendars in use across the world, studies hav e also been extended to examine the various calendar effects, many of which include ethnic and religious festivals (for example, see Chan et al., 1996). Cadsby and Ratner (1992) provide evidence to support the presence of country – specific holiday effects b ased on different holidays observed across different countries. In Asia, the main focus has been on the Chinese New Year (CNY) effect. Given the high concentration of Chinese population , particularly within the Southeast Asia region, CNY is observed as a major festival in Hong Kong, Taiwan, Singapore and Malaysia. The day is marked as a public holiday across those countries. Even in the Philippines and Thailand where Chinese are a minority, CNY is celebrated on a smaller scale. Wong et al. (1990), Tong (1992), Lee et al. (1992), Yen and Shyy (1993) and Ahmad and Hussain (2001) have identified the strong presence of CNY effect across Southeast Asian countries. The CNY effect is described by the significant high returns on the days preceding the Chinese Lunar New Year. Chan et. al. (1996) attributed the phenomenon to the practice by which Chinese enterprise owners issue cash bonuses (wrapped in small red envelopes called Ang Pow) to employees. In order to finance the cash bonuses, the enterprise owners may have liquidated part of their investment portfolios, depressing stock prices prior to the holiday before returning to normal return pattern afterwards. Such behavior offers other investors an annual opportunity to profit. S brought to you by COREView metadata, citation and similar papers at core.ac.ukprovided by Clute Institute: Journals

PAGE – 2 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 12 In addition to the CNY celebr ation, the Muslim population , which is a majority in Malaysia and Indonesia, have their own celebrations. One of the important festivals in the Islamic calendar is Eid al – Fitr (known in Malaysia as Aidil Fitri) which marks the end of Ramadan (which is the fasting month) and the arrival of Shawal. The festival is a grand celebration in Malaysia , and one of the unique practices during this celebration is money – giving from older individuals to younger individuals, among families, relatives and friends. Of late, the Muslims even adopt ed the practice of the Chinese of using small green envelopes to place the money. But what is more important is that the practice of giving cash bonuses is being adopted by employers to reward their Muslim employees. The Musl ims in Malaysia make up about half of the population. Generally, Muslims are also Malays who, under the constitution, receive certain privileges by virtue of being the Bumiputeras (native people of the land). Through various government policies and effor ts, a new breed of entrepreneurial Bumiputeras has been produced who now own and run many large corporations , including publicly listed companies (see Cheong, 1993, Gomez and Jomo, 1997 and Searle, 1999). In addition, the majority of the workforce are Bum iputeras who make up the majority of the population. Therefore, it is not surprising that come Eid al – Fitr, some of Malaysian companies give cash bonuses as an incentive for their employees who are in need of extra cash in view of the upcoming celebration . Using the same argument put forward by Chan et al. (1996), one would expect that an Eid al – Fitr effect might exist in Malaysia, similar to CNY effect. Wong et al. (1990) detect the presence of an Eid al – Fitr effect in Malaysia but , surprisingly , t he effect is negative. Chan et al. (1996), on the other hand, do not detect the presence of Eid al – Fitr effect. Based on these previous studies, the present study is designed to seek additional evidence that can help detect and explain the existence or n ot of an Eid al – Fitr effect. This study benefits from the use of recent time series data which have been thoroughly refined to minimize the potential of data distortion which can affect the outcome of the study. The findings will add to the literature in understanding the behavior of stock prices in a predominantly Muslim country. The following segment describes the data and methodology employed , followed by presentation of the findings and discussion of the results. Finally, a conclusion is drawn. DA TA AND METHODOLOGY While previous studies employ the Kuala Lumpur Stock Exchange 1 (KLSE) Composite Index (KLCI) as a proxy for market performance, this study opts for the Syariah Index (SI) owing to the fact that the performance of KLCI may incorporate th e influence of other events that take place during the period of this study. For instance, during the sample period from 2000 to 2003, the Eid al – Fitr celebrations coincide with many other ethnic and religious festivals in Malaysia such as Chinese New Yea r, Christmas and Deepavali 2 . By using the KLCI, the findings may not exclusively report the effect of Eid al – Fitr, but other events as well. To mitigate the problem, this study employs the SI which represents stocks of companies whose core business acti vities conform to the permissible activities as prescribed by the Islamic law. 3 These SI stocks are traded on the Main Board of the stock exchange. The choice of SI is deemed relevant given the growing awareness and interest among Muslims in Malaysia tow ard Islamic – based investment products. By assuming that Muslims, both at the individual and corporate levels, tend to invest largely in approved Islamic stocks, the Eid al – Fitr effect, should it exist the way CNY effect is, can be measured by monitoring t he performance of the SI. As a control mechanism for the other events, the KLCI is also employed to represent the overall market sentiment. Using the two indices, adjusted daily excess return (ADER) is computed based on the following equation: ADER t = [Ln (SI t /SI t – 1 ) Ln(KLCI t /KLCI t – 1 )] x 100 Due to availability of data 4 , the study focuses on the period starting from 2000 to 2003 only. By excluding 1 From April 2004, the exchange is officially known as Bursa Malaysia. 2 This is due to the shorter cycle of the Muslim calendar year compared to the western calendar year. 3 The Securities Commissions (SC) of Malaysia forms the Shariah Advisory Council (SAC) whose main role is to study and give approval to companies that fit to be classified as permissible s tocks. 4 The Syariah Index was introduced in 19 April 1999.

PAGE – 3 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 13 the data prior to 2000, this study avoids taking into account possible effects due to the Asian financi al crisis of 1997 – 1998. Furthermore, the period under study represents a stable period after the Malaysian government introduced selective capital control policies in 1998. During these four years, Muslims celebrated the Eid al – Fitr festival five times ( twice in 2000). The time series data for each respective celebration is divided into three phases. Phase I represents 30 days before fasting begins. Phase II represents the period during the fasting month. Phase III represents the 30 days after the Eid al – Fitr holidays 5 . While Phase I and Phase III consist of 30 trading days, Phase II covers less than 30 days due to the nature of the Islamic calendar 6 . Following Chan et al. (1996), OLS analysis is performed to trace for the presence of an Eid al – Fitr effect. The model is represented by the following equation: h ADER t = i D i,t + t i=0 where, ADER t = the return at time t ; i = the return component attributable to the i th characteristic; D i,t = the dummy variable taking on the value 1 where th e t th observation has the characteristic i and 0 otherwise; and t = an error term. In line with the objective of the study, it is hypothesized that should an Eid – al – Fitr effect exist in Malaysia, an abnormally significant high return will be detected dur ing or near the end of Phase II which is the immediate period before the celebration. This is consistent with the premise of CNY effect which sees stock market rallying upwards in the days leading to the festival to yield positive returns. In addition, P hase I and Phase III are not expected to yield abnormal return considering that they cover the period distance from and immediately after the celebration. Data used in this study is obtained from Datastream . RESULTS AND DISCUSSI ON Table 1 presents the de scriptive statistics for the average adjusted daily excess returns for the period under study. The average adjusted daily excess return for the overall period is found to be negative ( – 0.004004). However, the returns for the first two phases are found to be positive (i.e. 0.036975 and 0.017084), unlike the return for Phase III which is negative ( – 0.029166). Tests for the equality of means between the three phases, nevertheless, fail to show a statistically significant difference between the three means, the F – statistic is 0.441656. As such, the average adjusted daily excess return for the three phases is statistically equal. Although the Jarque – Bera test rejects the null hypothesis of normally distributed series of adjusted daily excess return for the o verall period (i.e. – normal stable distributions are a better paper, it is assumed that the daily returns follow a normal distribution. The same assumption was made by Seow and Wong (1998) despite the non – normality of the data used. Table 1 : Descriptive S tatistics RETURN RETURN1 RETURN2 RETURN3 Mean – 0.004004 0.036 975 0.017084 – 0.029166 Median – 0.001210 0.045899 0.040400 – 0.019176 Maximum 5.079197 0.623625 0.782485 0.871491 Minimum – 4.756808 – 0.685011 – 0.585056 – 1.728898 Std. Dev. 0.590336 0.240177 0.242819 0.392699 Skewness – 0.226765 – 0.274733 0.038627 – 0 .723357 Kurtosis 24.96781 3.449003 3.450375 5.560833 Jarque – Bera 24521.73 3.146975 0.870023 54.06781 Probability 0.000000 0.207321 0.647257 0.000000 Observations 1219 150 100 150 5 In Malaysia, the government declares two days of public holidays to mark the Eid al – Fitr celebration. 6 One of the common practices to determine the arrival of Eid al – Fitr is by moon – sighting. Towards the end of Ramadan, Islamic astronomers will engage in moon – sighting activity around dusk to trace the beginning of Shawal which is a new month following Ramadan. Should the moon be sighted, the month of Shawal is declared to start the next day. Otherwise, Ramadan will last another day before Shawal begins. The arrival of Shawal marks the end of fasting month, follows by the Eid al – Fitr celebration.

PAGE – 4 ============

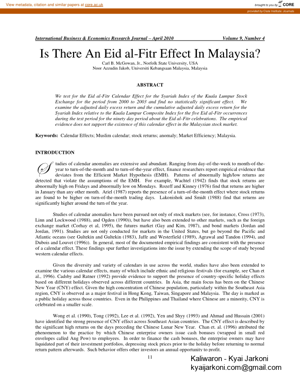

International Business & Economics Research Journal April 2010 Volume 9, Number 4 14 Table 2 reports the results from OLS analysis for the overall data. The coefficients for the dummy variables that represent Phase I, Phase II and Phase III are not found to be statistically significant. As such, these results fail to support the presence of an Eid al – Fitr effect in the Malaysian stock market. In additio n, the results from the Wald Co efficient Restriction Test fail to reject the null hypothesis with an F – Statistic = 0.489019. These results suggest that the returns generated during the three phases are not statistically significantly different. Table 2 : Results from OLS A nalysis for O verall P eriod Variable Coefficient Std. Error t – Statistic Prob. PHASE1 0.036975 0.048221 0.766792 0.4434 PHASE2 0.017084 0.059058 0.289279 0.7724 PHASE3 – 0.029166 0.048221 – 0.604840 0.5454 A detailed analysis of the event confirms the absence of Eid al – Fitr effect , judging by the results presented in Table 3. For each celebration during the five respective Muslim calendar years, the coefficients obtained from the OLS analysis for all three phases are not found to be statistically significant (with the exception of the coefficient for Phase II in year 1423 , which is found to be weakly significant). In addition, Appendix B provides further evidence to support the absence of an Eid al – Fitr effect. The average adjust ed daily excess return for the 50 days leading to the event and 30 days after the event is not statistically significantly different from zero (with the exception of Days – 42, – 39, – 36, – 24 and +23). As such, the study results fail to trace any abnormal r eturns that can render support to the presence of an Eid al – Fitr effect. Table 3: Results from OLS Analysis for Individual Year Muslim Year Phase I Phase II Phase III 1420 0.078060 0.073014 0.057600 (0.356794) (0.272492) (0.263275) 1421 0.055995 – 0. 080135 – 0.040899 (0.976741) ( – 1.141320) ( – 0.713419) 1422 – 0.006753 – 0.031786 – 0.091225 ( – 0.099691) ( – 0.373417) ( – 1.346671) 1423 0.012257 0.092935 – 0.054019 (0.295565) 1.875020)* ( – 1.302630) 1424 0.045318 0.025157 – 0.017287 (1.127343) (0.510968) ( – 0.430032) * = significant at 10 percent (t – statistics are reported in brackets) Graphically, Figure 1 (top) shows the trend of the average adjusted daily excess returns during the three phases. With the exception of small deviations at the beginning and towards the end of Phase III, the returns tend to move within a constant range throughout the three phases. Therefore, the results do not suggest the presence of abnormal returns during these periods. The small deviations of returns may help explain t he non – normality of the average adjusted daily excess return during Phase III. Figure 1 (bottom) provides a graphical description of the cumulative adjusted daily excess return and shows that positive returns are generated during the first two phases (t he periods prior to Eid al – Fitr). The positive returns during Phase I are greater than the returns during Phase II , judging by the steepness of the upward trend. The cumulative returns drop sharply immediately after Phase III begins. As such, the positi ve cumulative return fails to continue. Instead, the drop in return has resulted in negative average adjusted daily excess returns during Phase III. Therefore, these results confirm the absence of an Eid al – Fitr effect. Graphically, the presence of an e vent effect is indicated by an upward cumulative return leading to the event and its continuation to remain at the new level after the event. The empirical findings of this study tend to agree with Chan et al. (1996) who find no empirical evidence to supp ort the presence of an Eid al – Fitr effect despite the strong presence of a Chinese New Year effect. This suggests

PAGE – 5 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 15 that despite the increasing number of corporations that resort to the practice of giving bonuses during Eid al Fitr celebrations, either the p ractice is not financed from stock market activities, unlike CNYs, or the magnitude of these bonuses is small enough that corporations do not need to use investment portfolios to finance the cash bonuses. Whatever the reasons, this study shows that one sho uld not expect the stock market to stage a rally during the Eid al – Fitr festivals. As far as investment strategies go, market participants may not be able to benefit much from this event given that random walks prevail. A number of issues are worth highl ighting about the Eid al – Fitr effect. First, despite the increasing number of Bumiputeras participating in the stock market, the number is small in comparison to the number of Chinese who participate in the stock market by the ratio of three to one (Majid , 1996). As such, the impact of Muslims adjusitng their investment portfolios to create a excess returns for other investors may not be as significant as their Chinese counterpart. Second, the amount of cash bonuses given out during the Eid al – Fitr celeb rations are normally not as generous as the cash bonuses offered during the Chinese New Year celebrations. While the practice is widespread, Muslims in general spend moderately from the money given out during these celebrations. The spirit of Eid al – Fitr , after all, is not about spending but more on seeking forgiveness from one another. Only recently has the practice of paying cash bonuses become common, but obviously its impact on the stock market is minimal. Finally, some Muslims consider taking part in the stock market is equivalent to gambling. Given that gambling is forbidden under Islam, there is a possibility that Muslims refrain from using income generated from stock markets to finance a religious – based celebration like Eid al – Fitr. Figure1 : Average and Cumulative D aily E xcess R eturn D uring the P eriod U nderstudy CONCLUSIONS In the spirit of Chinese New Year effect , which is found to be prevalent in the Southeast Asian stock markets, this study examines the Eid al – Fitr effect in Malaysia. Using OLS analysis, the empirical results fail to detect evidence that supports the presence of Eid al – Fitr. These findings can be linked to a number of reasons. First, the presence of Bumiputeras in the stock market is still r elatively small. Second, the practice of giving cash bonuses during Eid al – Fitr celebrations is not of the same magnitude as the Chinese New Year. And, finally, the stock

PAGE – 6 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 16 market is not considered pure enough to make money from religious celebration s like Eid al – Fitr. In short, the Eid al – Fitr festival is not a significant event that can lead to a calendar effect in Malaysia. AUTHOR INFORMATION Dr Noor Azuddin Yakob is an Associate Professor at the Graduate School of Business, Universiti Kebangsaan Mal aysia (UKM – GSB). He was a Visiting Research Fellow at the University of Southern Queensland, Australia and a Visiting Lecturer at the Tashkent State Technical University, Uzbekistan and University of Science and Technology, Yemen. His research interests ar e in the fields of financial markets and corporate finance. He is now the Head of Masters programs at UKM – GSB. REFERENCES 1. Agrawal, A. and K. Tandon. 1994. Anomalies or illusions? Evidence from stock markets in eighteen countries. Journal of International Money and Finance , 14: 83 – 106. 2. Ahmad, Z. and S. Hussain. 2001. KLSE long run overreaction and the Chinese New Year effect. Journal of Business Finance & Accounting . 28: 1 – 43. 3. Ariel, R. 1987. A monthly effect in stock returns. Journal of Financial Economic s , 18: 161 – 174. 4. Cadsby, C. B. and M. Ratner. 1992. Turn – of – month and pre – holiday effects in stock returns. Journal of Banking and Finance , 16: 497 – 509. 5. Chan, M. W. L., A. Khanthavit, and H. Thomas. 1996. Seasonality and cultural influences on four A sian stock markets. Asia Pacific Journal of Management , 13:1 – 24. 6. Cheong, S. 1993. Bumiputera controlled companies in the KLSE , 2 nd Ed. Modern Law Publishers and Distributors: Petaling Jaya. 7. Corhay, A, A. M. Fatemi, and A. T. Rad. 1995. The presence of a da y – of – the – week effect in the foreign exchange market. Managerial Finance , 21: 32 – 43. 8. Cross, F. 1973. The behaviour of stock prices on Fridays and Mondays. Financial Analysts Journal , 29: 67 – 69. 9. Dubois, M. and P. Louvet 1996. The day – of – the – week effect: th e international evidence. Journal of Banking and Finance , 20: 1463 – 1484. 10. Fama, E. 1970. Efficient capital markets: a review of theory and empirical work. Journal of Finance . 25: 383 – 417. 11. Gay, G. and T. Kim. 1987. An investigation into seasonality in the fu tures market. Journal of Futures Markets , 7: 169 – 181. 12. Gomez, E. T. and K.S. Jomo. 1997. . Cambridge University Press: Cambridge. 13. Gultekin, M. and N. Gultekin. 1983. Stock market seasonality: Inte rnational evidence. Journal of Finance Economics , 12: 469 – 481. 14. Jaffe, J. and R. Westerfield. 1989. Is there a monthly effect in stock returns: Evidence from foreign countries. Journal of Banking and Finance , 13: 237 – 244. 15. Jordan, S. and B. Jordan. 1991. Se asonality in daily bond returns. Journal of Financial and Quantitative Analysis , 26: 269 – 285. 16. Lakonishok, J. and S. Smidt, 1988. Are seasonal anomalies real? A ninety – year perspective. Review of Financial Studies , 1: 403 – 425. 17. Lee, C. F., G. Yen and C. Chan g. 1992. The Chinese New Year, common stock purchasing and cumulative Capital Markets . Greenwood Press: Westport. 18. Linn, S. and L. Lockwood. 1988. Short – term price patterns: NYSE, AMEX, and OTC. Journal of Portfolio Management , 14: 30 – 34. 19. Ogden, J. 1990. Turn – of – month evaluations of liquid profit and stock returns: A common explanation for the monthly and January effect. Journal of Finance , 45: 1259 – 1272. 20. Maji d, M. S. A. 1996. Pasaran saham: Isu – isu semasa dan analisis . UtusanPublications & Distributors Sdn Bhd: Kuala Lumpur.

PAGE – 8 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 18 APPENDIX A Impor tant Muslim Dates in This Study Year Shawal holidays Ramadan starts 2003 25 – 26 November 27 October 2003 2002 6 – 7 December 6 November 2002 2001 16 – 17 December 17 November 2001 2000 27 – 28 De cember 28 November 2000 8 – 9 January 9 December 1999 Muslim New Year Western Calendar Equivalent 1 Muharam, 1424 22 February, 2004 1 Muharam, 1423 5 March, 2003 1 Muharam, 1422 15 March, 2002 1 Muharam, 1421 26 March, 2001 1 Muharam, 1420 6 April, 2000 1 Muharam, 1419 17 April, 1999

PAGE – 9 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 19 APPENDIX B Day Mean Std Dev SE Mean t – stat p – value – 50 8.53E – 02 0.1015202 4.54E – 02 1.88 0.133 – 49 5.08E – 02 0.1427985 6.39E – 02 0.795 0.471 – 48 – 2.25E – 02 0.3952776 0.1767735 – 0.127 0.905 – 47 – 9.50E – 02 0.1573691 7.04E – 02 – 1.35 0.248 – 46 7.17E – 02 0.3982707 0.1781121 0.403 0.708 – 45 4.43E – 02 0.3902069 0.1745058 0.254 0.812 – 44 – 8.29E – 02 0.1616184 7.23E – 02 – 1.147 0.315 – 43 – 5.67E – 02 0.1616922 7.23E – 02 – 0.784 0.477 – 42 8.87E – 02 9.17E – 02 4.10E – 02 2. 164 0.096 * – 41 – 4.30E – 02 0.1947219 8.71E – 02 – 0.494 0.648 – 40 0.150515 0.3090797 0.1382246 1.089 0.337 – 39 0.207258 0.1020855 4.57E – 02 4.54 0.01 *** – 38 – 4.76E – 02 0.1242826 5.56E – 02 – 0.857 0.44 – 37 4.33E – 02 0.2656467 0.1188008 0.364 0.734 – 36 0.2 513538 0.1724635 7.71E – 02 3.259 0.031 ** – 35 9.95E – 02 0.2359285 0.1055104 0.943 0.399 – 34 2.65E – 02 4.62E – 02 2.07E – 02 1.283 0.269 – 33 – 2.81E – 02 0.2789141 0.1247342 – 0.225 0.833 – 32 – 4.00E – 02 0.1662595 7.44E – 02 – 0.538 0.619 – 31 – 1.65E – 02 0.3669737 0 .1641156 – 0.1 0.925 – 30 – 0.1149532 0.354646 0.1586025 – 0.725 0.509 – 29 0.1538834 0.1811018 8.10E – 02 1.9 0.13 – 28 0.1451688 0.2729159 0.1220517 1.189 0.3 – 27 – 5.20E – 02 0.2156229 9.64E – 02 – 0.539 0.619 – 26 5.55E – 02 0.1523272 6.81E – 02 0.815 0.461 – 25 0.1259024 0.165719 7.41E – 02 1.699 0.165 – 24 0.1962066 0.1148365 5.14E – 02 3.82 0.019 ** – 23 – 3.49E – 02 0.3733056 0.1669473 – 0.209 0.845 – 22 – 0.144418 0.3157318 0.1411996 – 1.023 0.364 – 21 9.16E – 02 0.224595 0.1004419 0.912 0.413 – 20 6.65E – 02 0.2232 954 9.99E – 02 0.666 0.542 – 19 5.85E – 02 0.2382073 0.1065295 0.549 0.612 – 18 0.2069872 0.3461241 0.1547914 1.337 0.252 – 17 – 1.75E – 03 0.2227237 9.96E – 02 – 0.018 0.987 – 16 6.66E – 02 0.1535911 6.87E – 02 0.969 0.387 – 15 6.48E – 02 0.1420266 6.35E – 02 1.021 0. 365 – 14 8.55E – 03 0.2582998 0.1155152 0.074 0.945 – 13 4.77E – 02 0.2126154 9.51E – 02 0.502 0.642 – 12 2.63E – 02 0.1446593 6.47E – 02 0.407 0.705 – 11 7.40E – 02 0.3480481 0.1556518 0.475 0.659 – 10 – 1.90E – 02 0.1613835 7.22E – 02 – 0.263 0.806 – 9 – 0.1663608 0. 3073985 0.1374728 – 1.21 0.293 – 8 0.113451 0.1833493 8.20E – 02 1.384 0.239 – 7 1.98E – 02 0.1539486 6.88E – 02 0.287 0.788 – 6 – 0.1317038 0.2545062 0.1138186 – 1.157 0.312 – 5 9.41E – 03 0.3517545 0.1573094 0.06 0.955 – 4 – 1.49E – 02 0.2375899 0.1062534 – 0.14 0 .895 – 3 8.72E – 02 0.3325688 0.1487293 0.586 0.589 – 2 – 0.1393916 0.3207224 0.1434314 – 0.972 0.386 – 1 5.80E – 02 7.67E – 02 3.43E – 02 1.693 0.166 1 – 9.31E – 02 0.21 9.31E – 02 – 1 0.374 2 – 0.2860202 0.5515069 0.2466414 – 1.16 0.311

PAGE – 10 ============

International Business & Economics Research Journal April 2010 Volume 9, Number 4 20 APPENDIX B continued Day Mean Std Dev SE Mean t – stat p – value 3 – 0.299368 0.8581926 0.3837954 – 0.78 0.479 4 – 0.3525316 0.5526032 0.2471317 – 1.426 0.227 5 – 0.3076002 0.5994193 0.2680684 – 1.147 0.315 6 0.2161702 0.387597 0.1733387 1.247 0.28 7 – 6.68E – 02 0.1841376 8.23E – 02 – 0.812 0.463 8 – 0.1743868 0.2483798 0.1110788 – 1.57 0.192 9 0.120684 0.1615731 7.23E – 02 1.67 0.17 10 – 5.50E – 02 0.1108104 4.96E – 02 – 1.11 0.329 11 8.02E – 02 0.3338067 0.1492829 0.537 0.62 12 7.89E – 03 7.46E – 02 3.34E – 02 0.236 0.825 13 4.88E – 02 0.2493 676 0.1115206 0.437 0.684 14 0.1488672 0.3896051 0.1742367 0.854 0.441 15 3.44E – 02 0.3417865 0.1528516 0.225 0.833 16 2.58E – 02 0.4445135 0.1987925 0.13 0.903 17 0.1963978 0.4490529 0.2008226 0.978 0.383 18 – 5.42E – 02 0.4686877 0.2096035 – 0.259 0.8 09 19 – 3.84E – 02 0.4066703 0.1818685 – 0.211 0.843 20 – 6.85E – 03 0.2788976 0.1247268 – 0.055 0.959 21 – 8.05E – 02 0.3996108 0.1787114 – 0.451 0.676 22 – 1.58E – 02 0.3032354 0.135611 – 0.116 0.913 23 5.98E – 02 6.11E – 02 2.73E – 02 2.189 0.094 * 24 – 0.2315836 0 .3775754 0.1688568 – 1.371 0.242 25 7.95E – 02 0.3015057 0.1348374 0.59 0.587 26 – 0.1674674 0.3026652 0.135356 – 1.237 0.284 27 – 0.1265644 0.3302287 0.1476828 – 0.857 0.44 28 0.3305862 0.395315 0.1767902 1.87 0.135 29 3.27E – 02 0.5478692 0.2450146 0.13 4 0.9 30 0.118357 0.3861527 0.1726927 0.685 0.531 31 – 0.1118986 0.4013269 0.1794788 – 0.623 0.567 *, **, *** = significant at 10%, 5% & 1%.

164 KB – 10 Pages